The federal government promoted important changes to the tax regime for investments, financial transactions and tax compensations, through Provisional Measure No. 1,303/2025 and Decree No. 12,499/2025, published in an extra edition of the Official Gazette of the Union on June 11.

The new rules directly affect individuals and legal entities, especially in areas such as Income Tax on financial investments, tax compensation, and the incidence of IOF.

Although some of the changes will only take effect from January 2026, many of them will come into effect in 2025. It is essential to pay attention to deadlines and transition strategies.

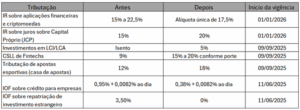

The main changes: